Paypal Fee Calculator, It’s hard to imagine what life was like for freelancers and entrepreneurs before online payment processing began. Neither of these services is more popular than PayPal. However, many freelancers and entrepreneurs are less than enthusiastic about paying some PayPal fees to receive money from customers.

It is true that paying a certain percentage of your income for money is painful. You might even be tempted to give up PayPal altogether for something at a lower cost.

However, there is a reason why PayPal is a top priority in the world of online payment processing. Nothing is as convenient as having a web-based payment gateway that connects directly to your bank account. Also, when it comes to requesting payment from customers, you want to offer a payment method that they already know and trust.

So, are you destined to pay every time a customer pays their bill via PayPal? To some extent, yes. However, there are ways to lower the PayPal fees for receiving money. You just have to know what to do.

Table of Contents

What is PayPal?

After more than 20 years in business, PayPal and e-commerce have almost gone hand in hand. Indeed, it’s difficult to recall when you couldn’t simply click a fasten and send cash to a companion, relative, or vendor.

Rather than giving your ledger data straightforwardly to organizations or people, PayPal goes about as a safe outsider and acts as third party. This not only means that your financial information remains confidential, it also means that you will be supported if something goes wrong with a transaction.

Because PayPal has been around for a long time, many people underestimate this service. However, as a freelancer or entrepreneur, your life will be much more difficult without this payment processing service. Unfortunately, there are also fees to pay for this handy service in detail in this blog.

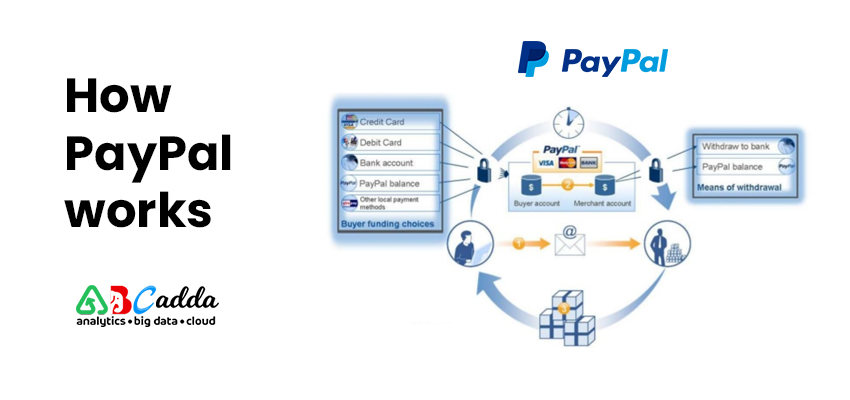

How PayPal works

PayPal offers payment services and solutions for personal and business customers. The company allows private users to shop, make payments and transfer money with relative ease.

Users will need an email address to sign up for an account and will need to provide a credit card, debit card, or bank account to complete setup. PayPal will review all information to ensure that the person who created the account is the rightful owner before the service can be used.

PayPal account holders can use the company’s website or mobile app to send money to other people using the recipient’s email address or mobile number. Buyers can choose the PayPal option to shop online if the Paypal Merchant fees has the service.

Transactions are completed in a few minutes and the company promises that direct transfers are available for payment or withdrawal to bank accounts.

PayPal also offers companies a variety of solutions for their day-to-day operations. These include payment portals for online and in-person transactions, paypal business fees management solutions, and credit and financing options. Business owners are also required to provide an email address to create an account.

PayPal tries to make online purchases safer by providing a payment method that doesn’t require the payer or payee to disclose any credit card or bank account numbers. Therefore, money is safe, confidentiality is protected, and because of the huge customer base, transactions are faster than traditional methods.

Why use PayPal?

While there are many online payment systems such as Apple Pay and Google Pay today, PayPal offers some additional benefits that others may not have.

Its age means it is well established and widely accepted by even smaller retailers. You can discover the alternative to pay by means of PayPal on many sites that don’t offer the equivalent for Apple Pay or other advanced financial administrations.

Taking precautions to protect the buyer will also ensure that you will receive a refund if an item purchased online does not arrive or match the seller’s description. This is especially useful when you buy items on eBay that are not normally guaranteed.

Those who sell goods on a personal or paypal business fees level and are paid for via PayPal are also protected. For example, if you can prove that you sent an item by mail but the buyer claims they didn’t receive it, you can keep the payment in full.

Another reason to use PayPal is that payments provide an extra layer of security. Since you don’t need to enter your CVV card or number every time you buy something, only your PayPal login and password or mobile number and PIN, the online shop doesn’t have your data in its database.

Sometimes you can also use OneTouch Payments where PayPal will keep you signed in when you activate the service and avoid having to enter your details every time you buy something, regardless of the store. This is because it’s device and browser specific. For example, if you activate OneTouch on your computer, it will only work if you are using that computer and browser.

What is the paypal fee?

Using PayPal to buy goods or service fee is free. However, if you receive money for goods or services (for example, from selling items on eBay), there is a fee for each transaction.

When does PayPal charge a fee?

The reason PayPal fees are so confusing to most people is that they vary slightly in every situation. The PayPal percentage can vary based on several factors, such as:

Your location, the country where you send / receive money if you have a business or personal account. PayPal’s general rule is there is no fee for internal private transactions (between friends and family in the same country).

The following are situations where fees are charged:

- When you receive payment for a purchase

- When you send or receive money from a country other than your location

- When sending a payment by debit or credit card

- When transferring money from PayPal to a debit or credit card (however, switching to a bank account is free)

There are also special discount rates for nonprofits that can come in handy if you meet the requirements.

What are PayPal fees

As you can see, the fees you have to pay can vary based on your buying situation – and there are a number of circumstances that can affect the amount you have to pay. Because of PayPal rules, five sequential separate transactions for a similar thing may bring about the installment of an alternate charge for everything.

Once you understand more about the various situations that can affect the cost of your payment, you should be aware of the different types of fees PayPal may charge you.

Knowing the exact numbers can prepare you when you need to cover the costs of doing business with that shopping cart. It can also help you understand how our PayPal fee calculator comes to its conclusion. Let’s break down each type for you:

Standard fees for domestic traders: As previously mentioned, this is the amount you pay when you receive a payment from someone who is in the same country as your company.

Paypal percentage that’s 2.9% of the payment you receive, plus 30 cents or the equivalent of a “flat fee” that how much are paypal fees PayPal charges for your currency if the country in question is not the US.

paypal goods and services fees calculator

The fact is that those who sell goods or services are charged PayPal fees for receiving money.

As an example:

If the buyer purchases goods through Sellfy, he (the buyer) will not be charged additional fees. However, Sellfy sellers will.

How much does PayPal cost? Here are the various costs that Sellfy sellers should pay attention to:

Paypal Merchant fees for international transactions: This is where things get interesting. If your business is located in one country and your customers are located in another, you will be charged paypal percentage 4.4% + 0.30 of the amount your customer provides.

As with any transaction, you’ll need to add a flat fee here too – especially for the country your customers shop in.

For example, if your company is registered in the UK but the customers are registered in the UK, you will pay 20p instead of 30 cents. PayPal fees a flat fee of four pesos for your customers in Mexico and 40 yen for your customers in Japan.

Exchange rate fees: This leads to the cost of converting those pounds, pesos and yen into dollars or for returning visas or other currency combinations. There is no set fee for this as the interest rate itself always goes up and down.

On the other hand, the amount you have to pay to convert currency changes regularly, as do banks and exchange offices.

All of these transactions require different processing than what meets the “standard” definition. As a result, PayPal has rules governing the imposition of additional fees for almost any situation that deviates from this expectation.

PayPal fee structure

Of course, PayPal doesn’t work for your heart. To stay in business, a company needs to generate revenue from its paypal service fee.

For this purpose, PayPal charges a fee for most transactions processed through the system. In most cases, this fee is passed on to the person or company who receives the money.

So how much do you expect each time you receive money via PayPal? First of all, PayPal charges a fixed interest fee for each transaction. This fee depends on the currency of the transaction.

How much does paypal take?

As already mentioned, the standard rate for every transaction made with PayPal is 2.9% plus 30 cents. This might seem pretty solid. However, if your business is growing significantly and having lots of transactions on a regular basis, you may feel heavier.

How much does Paypal charge processing fees?

Paypal transaction fee for each transaction. Neither the provider nor the administrator pays you: find out exactly how much.

Sharetribe does not charge market administrators any paypal transaction fees. However, PayPal does charge market vendors a payment processing fee for each payment transaction.

What percentage does paypal take for processing PayPal payments?

These costs consist of a paypal percentage of the total transaction price plus fixed costs. The fee is between 2% and 5%. It depends on three things: seller’s country, buyer country, and seller’s monthly sales volume.

Domestic purchases generally have a lower cost than international purchases, and larger sellers receive a discount on their fees.

Paypal processing fees

Once you understand how the online payment process works, the next thing you need to know is how much it costs and how the fees are usually structured.

This process may seem complicated, but it doesn’t have to be overwhelming. Let’s take a closer look at the costs here.

Credit card processing fee details

Unsurprisingly, everyone making a transaction wants to accept payments, including issuing banks, credit card associations (Visa, MasterCard, etc.), commercial banks and payment processors. Basically, every time you complete a transaction, you pay a few fees:

- Percentage of Number of Transactions: Issuers receive payments by taking a percentage of each sale which is called an exchange. This fee depends on a number of factors, such as: B. industry, number of sales and type of card used. The last time we checked there were almost 300 different exchange fees!

- Another percentage of the transaction amount: your commercial bank deducts it by charging an additional fee. Again, the amount varies depending on the industry, sales, monthly processing volume, etc.

- Review Fees: Credit Card Association (Visa, MasterCard, etc.) also charge a fee called review.

- Amount in dollars for each transaction processed: The payment processor (which could also be your commercial bank) makes money by collecting a fee every time a transaction is processed (be it a sale, cancellation, or refund – it doesn’t matter). In addition, there may be fees for setting up, monthly usage, and even canceling the account.

Typically, the first three fees (percentages) are charged and reported as a single rate, while transaction costs are reported separately How much are paypal fees 2.9% + $ 0.30.

How does PayPal calculate the fees?

PayPal automatically deducts costs when money is sent from the buyer to the seller. For example, if the total transaction amount is $ 100 and PayPal fees are 3%, the seller will receive $ 97 in their PayPal account and PayPal will deposit $ 3.

Lesser known additional PayPal fees

Apart from the fees already mentioned, which may be charged upon receipt of payment, there may be other, lesser-known costs that you may incur in running your online business.

They include:

- Withdrawal Fees: While they claim that direct withdrawals to your bank account are free, there are withdrawal fees outside the US and UK. Some banks may also charge an individual fee for withdrawals from PayPal.

- Refund Fees: When you refund a customer, you only receive a portion of your PayPal seller fees. This keeps costs fixed (for example in the US for domestic payments, that would be $ 0.30).

Appreciate your product right by understanding PayPal fees

The price of your product and its sale price determine how much profit you will have left. This information is important for your budget. However, many online merchants forget to factor in the fees PayPal charges on each transaction.

if you are using a PayPal shopping cart, you need to be aware of these costs so that you can easily raise your prices if necessary to ensure your budget is going in the right direction. Since PayPal transaction fees are based on a percentage, it’s not always easy to Calculate paypal fees.

So abcadda.com has created a useful PayPal fees calculator below. Just enter the amount and the calculator will do the rest.

What is Paypal Fee Calculator?

The PayPal Fees Calculator is an easy way to calculate paypal fees payments, including PayPal fees. There are times when we want the other party to pay PayPal fees. However, we don’t know how much it will cost. The PayPal Calculator from abcadd.com will help you solve that problem. You can calculate paypal fees costs with just one click!

How to use abcadda.com Paypal Fee Calculator?

Paypal Fee Calculator are fast and easy to use. Quickly calculate deductions when sending or receiving money via PayPal.

All you have to do is:

- Enter the amount.

- Click the Calculate fees button.

- Click briefly on the calculate button, your total costs will be displayed immediately below.

- This tool also shows the money you will receive after deducting.

- It even shows you the money you need after deducting a certain amount of fees.

- To clear the amount entered, reset the tool by clicking the reset button.

This! PayPal fee calculator simplifies payment calculations. Only by entering the relevant amount can you find out how much to pay or receive. This tool supports the standard fees that PayPal charges for international transactions.

Why Does Business Need a Paypal fee calculator?

PayPal calculator makes it easy to calculate individual fees and expenses. This ensures that your calculations are done correctly, even for a moment. If you own a business and your buyers / customers use PayPal, you’ll need to pay a fee. Since you carry out multiple transactions every day, a PayPal fee calculator can be a useful tool for you.

- Error-free counting: Manual counting causes errors and can affect gross sales. PayPal’s cost calculator, on the other hand, prevents mistakes. It is more accurate than manual calculation.

- Save time: With PayPal’s cost calculator, you can quickly and easily track deductions and costs. It saves you valuable time which you can use for your important business activities.

- Automatic counting: The calculation is done automatically. Taxes and deductions are based on standard PayPal fees.

- Anywhere Access: You can use PayPal Fees Calculator anywhere, anytime. Just run the tool and you can make calculations on the go.

How does the Paypal fee calculator work?

We have designed our website to be very user friendly and user friendly so that our users don’t have to waste time understanding the costs.

We implement all types of payments / transactions in our software, such as Standard Fees, Merchant Accounts, International, Personal Payments / Sales, Micropayments, Non-profit, and others. Just write down the number you need to check and that’s it.

How much does PayPal charge for various accounts?

- Send personal payments to PayPal: PayPal does not charge 0 or 0 in the US for sending money to friends and family when you make a transaction using a bank account or PayPal balance, or a combination of the two. However, if you use your credit or debit card, there is a problem that PayPal charges. You can find out who to bill you on the PayPal seller Fees.

- Accept direct payments with PayPal: There is no charge for receiving money from friends or family members within PayPal in the US when they make transactions using a bank account or PayPal balance, or a combination of both.

- Paypal goods and services fee calculator cost : You can use PayPal for free to buy goods or services. However, if you receive money for paypal service fee or goods such as money from selling products on eBay or Amazon, there is a fee for each transaction.

- International payments: There are certain fees when you receive a payment from someone in another country or when you receive money from someone in another country. The PayPal customer agreement contains specific information.

- Withdraw money: Withdrawing money from PayPal to your bank account isn’t worth it and it will show up in your bank in a few minutes. On this page you can see an overview of all costs.

Conclusion

Together with PayPal, Invoicing provides a seamless and reliable way for customers to pay you for products or services. And when you have to manage an entire company, convenience is a necessity.

However, invoicing doesn’t just help you create high-quality invoices. Plus, you can include a direct link to PayPal on each of your invoices to make life easier for your customers.

We wish that you had an answer to the paypal question you have “How does PayPal work“. If someone asks you a basic question, rest assured that they will be easy to answer.

It doesn’t matter whether you use PayPal for your personal needs or for your ecommerce website. They know this is one of the most convenient and secure ways to process online payments.

Also, your customers who don’t have a PayPal account can use this link to process their invoices quickly and easily. All you have to do is enter your payment details and press a button.

Paypal fee calculator or Paypal seller calculator

This is the best PayPal fee calculation website on the web, specially designed to calculate the exact fee PayPal charges for each transaction. You can easily calculate how much you will get when someone sends you money and how much you will send them to get the exact amount.

If you want to calculate exactly how much PayPal deducted, enter any amount in the “Enter amount” field. You will receive the exact amount that PayPal charges for each transaction.