MidFirst Bank, the largest private bank in the United States, offers a wide range of retail, commercial, trust, private banking and mortgage products. The bank has more than 250 separate banks with major branches and markets in Oklahoma City, Tulsa, western Oklahoma, Denver, Phoenix and Dallas.

This in-depth review will help you decide if MidFirst Bank is right for you. MidFirst Bank is a private bank headquartered in Oklahoma City that was founded in 1954 under the name The Midland Group, became MidFirst Bank in 1982 and primarily serves in the Southwest United States.

They have a stable product offering including checking accounts, savings accounts, mortgages, loans, CDs, and retirement accounts. F

ollowing the 2018 JD Power Index Award of 877, the highest total score of any US bank, MidFirst again received the highest score for consumer satisfaction in the Southwest 1 2 region in the JD Power US retail customer satisfaction survey for 2019.

First, learn how to midfirst bank login with a midfirst bank online – if you are a first Mid Bank customer, have a valid username and password, and have registered for an midfirst online banking account.

Therefore, you will find useful information here to make it easier for you to access midfirst bank online banking sites. (You will find all useful information for entering MidFirst Bank, the online entry for first Mid Bank)

Our guide will help you log into Midfirst Bank online, reset your password, call the hotline and much more to manage your credit card midfirst bank login account with Midfirst Bank.

Table of Contents

Who is the best match for MidFirst Bank?

MidFirst Bank is a great choice for people who live in the Southwest and are looking for a complete banking experience with excellent customer service.

- Competitive CD prices

- A unique eChecking account that waives fees and pays competitive interest based on online account activity

- Private rental services for cars, boats, RVs and motorbikes

- Unique Oklahoma credit cards, including the Oklahoma City Thunder

Account type

First Mid Bank offers a variety of accounts and services in competition with larger banks:

- Savings and money market accounts

- Check account

- Certificates of deposit

- Credit card

Savings and money market accounts

MidFirst Bank has several savings and money market accounts. Savings and money market accounts are equipped with:

- Six free withdrawals per monthly billing cycle

- Free online and mobile banking and free electronic account statements

- Compound interest on an interest account

- Possibility to combine your monthly bank statements with your current bank statement

- FDIC insurance up to $ 250,000

- You can save money by using EasySave rounding for debit purchases

Website practice

Information collection, use and sharing practices that apply to website visitors and mobile app users.

MidFirst login does not knowingly sell or solicit information from children under the age of 13 without parental consent.

The informational practices of this website are effective from July 2016 and may be updated from time to time. We will notify you of changes to the information practices of this website by posting the updated policies on our website and on the Mid First Bank mobile application from the updated effective date.

Practice Information at MidFirst.com

For the purposes of this website’s informational practices, “you and you” means users having access to the midfirst.com website. “MidFirst, we, we or our” means Mid First Bank. Depending on your use and choices when visiting midfirst.com, www.midfirst.com online collects the following categories of personal information:

- First and last name

- Residential or other physical addresses, including street names and city or town names

- Email address

- Phone number

- Geographical position

- IP address

- operating system

- Internet provider

- Mobile or tablet device

- Data and attributes about the device used to warn and detect fraud

We also collect user IDs and passwords, account numbers and transaction information from MidFirst customers.

MidFirst Bank Information Practice for Mobile Applications

As it were, MidFirst clients with iManage Individual Managing an account accreditations can utilize the MidFirst Bank versatile app. Depending on your choices made when using the MidFirst Bank mobile application, the following categories of personal information are collected for each user using the MidFirst Bank mobile application:

- Family name

- Email address

- MidFirst customer ID and password, account number and transaction information

- Phone number

- Device type

- Mobile operator

- Phone or device operating system, transaction information including information about each mobile deposit

- Photo of all deposits made by remote deposit (check deposits for photos)

- Geographical position

- IP address

- MidFirst Bank Mobile App Version

- Data and attributes about the device used to warn and detect fraud

In general, we may disclose information entered in the MidFirst Bank mobile application to third party service providers with whom we have a business relationship to maintain and maintain the MidFirst Bank application and / or mobile account, to provide services or make transactions on user requests or process requests. users.

If you are using the MidFirst private Bank mobile application, you can notify us of changes to your personal information by contacting MidFirst private bank.

MidFirst Online Banking – MidFirst Bank Online Login

Founded in 1982 in Oklahoma, Midfirst login offers a wide range of banking services and is the largest private bank in the United States. The Oklahoma City-based company provides retail, commercial, trust, retail and mortgage banking products and services to millions of customers.

With so many employees, Midfirst login offers net banking services, Midfirst Online Banking, an easy way to access your Midfirst Bank credit card online. To take advantage of the Midfirst Bank Online Banking and Mobile Banking platforms, you must first know how to log in.

Steps for Midfirst Bank online registration

If you already have an online bank account and want to log into your account, do the following:

- Go to the Midfirst Bank homepage here.

- Now select the service you want to get.

- Enter your bank ID correctly and click SIGN IN.

- On the next page, enter the correct password for the account to access your account.

You will now be forwarded to your MidfirstBank online bank account so you can use the additional online banking options from Midfirst Bank.

How do I register for Midfirst Bank online banking?

Go to the Midfirst Bank homepage here.

- Now click on the REGISTER option next to login.

- You will now be promoted to complete your registration.

- On the next page, select the account type.

- Read and accept online announcements and agreements.

- Enter your account information for verification purposes.

You will need to provide the following:

- Social security number

- Date of birth

- Valid identification documents, eg. Driver’s license / passport / country ID / military ID

- Address

- Employment information

- Email address

- Account number / credit card number / charge card number

- Finally, click NEXT to send the bank details.

After completing this process, the bank will send an email to your registered email address with your credentials.

Advantages of Midfirst Online Banking Login

- View your account balance

- Track payment history

- Set up recurring payments

- Set up account notifications with Messenger

- Make a payment to the account

- See Payments for Pending Invoices

- Make bill payments with teeth

- Transfer money from your account to another account

- Pay bills easily using ePay

- Stop paying with paper checks

- Extract and print monthly reports online

How do I log in to my Net Banking account?

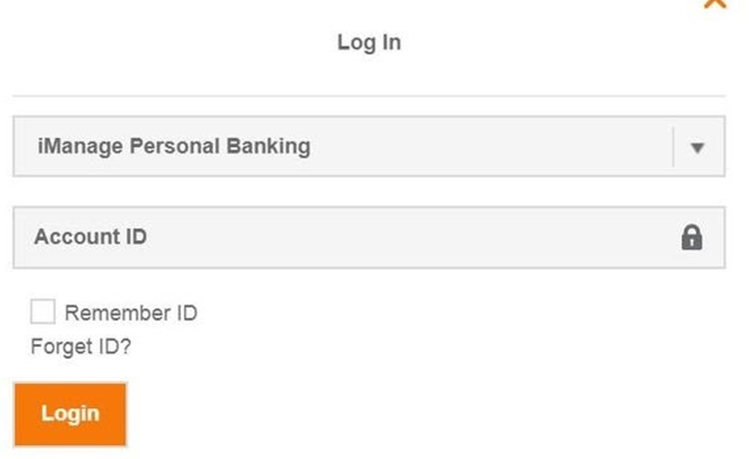

If you already have internet banking details, you may be able to click the link above to take you to the image below.

Personal Banking users must select Online Banking on the left tab. This will take you to the login page (see image below):

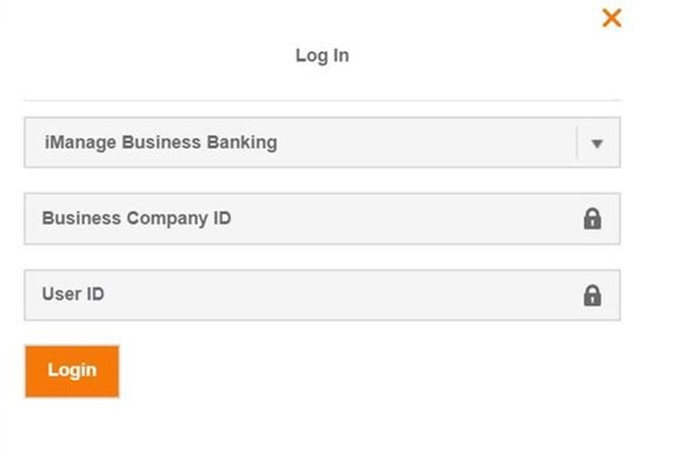

Otherwise, if you are a corporate customer with a checking account, you will need to select the link for the commercial bank image in the left panel and click Enter. Clicking on it will take you to the login page.

After the data is sent, the bank will activate the internet banking service. Customers can log into internet banking.

Other financial products from MidFirst Bank

- MidFirst Bank offers consumers various other offers:

- IRA

- Mortgage

- Home loans and lines of credit

- Personal loans

- Vehicle loans

- Retail banking

- Asset management

- Investment services

- MidFirst Bank customer service

How to become a bank with MidFirst Bank

You can open an account with a midfirst bank online login, in person at a branch, or by calling 1-888-643-3477. When you open an online account, you will need to provide your personal information and be ready to make your first deposit via wire transfer from another bank.

Conclusion

Here everything revolves around MidfirstBank online banking, its functions and the registration process for the new MidfirstBank online banking account.

If you have specific suggestions about this manual; Enter First Half Bank, let us know in the comments section and make your decision online.

MidFirst Bank offers free online and mobile banking services, FDIC insurance, and round-the-clock automated customer service.

Customer support is available Monday to Friday from 7:00 am to 9:00 pm at 1-888-643-3477. Pacific, Saturday 8am to 6pm Pacific Time and Sunday 12pm to 4pm Central Time.

The bank is currently involved in a lawsuit accusing him (along with Chase and Academy Bank) of illegally refusing to pay agents assisting applicants for the Salary protection program.