Table of Contents

Overview of www wellsfargo com login

www wellsfargo com login, wells fargo login, Wells Fargo’s internet banking services will enable customers to manage their bank accounts and find ATMs and bank locations in the state. It is a national association bank that offers full services. It makes loans, accepts deposits, and offers a number of services to the public. You can create your account in wellsfargo com login through www wellsfargo com login wf com login.

It is free to set up an online account with the bank if the customer has a bank account with the same bank. Internet banking services are accessible for both individuals and business making.

In this article, you will learn

- How to login into your account using wells fargo checking login

- How to change your password

- How to register for the online services

How to login into your www wellsfargo com login account

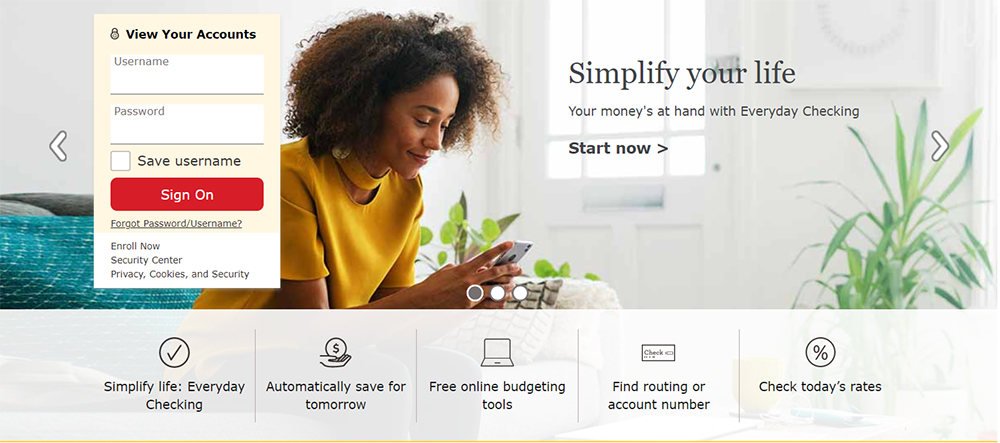

The bank has a website with a user-friendly interface. So this makes it easy for customers to log in and bank anytime. There are few steps you will need to follow to access your wellsfargo.com login online account:

Step 1: First start your computer, then open your browser and enter https://www.wellsfargo.com wellsfargo sign in page.

Step 2: users will have to Enter username and password to log-in

If you have used the right password, you can navigate to your dashboard.

How to change your password on www wellsfargo com login

If you have forgotten your password or reset it for security purposes, you can reset it on your own by simply switching on your computer and selecting the option Wells Fargo password change, and follow these steps:

Step 1: Go to the bank’s homepage and click the forgot password/ username.

Step 2: To reset your password you can click “create new password” and reset your username and then click “find the username.” In this case, we will cover how to reset your password.

Step 3: key in your username or social security number or Individual Tax identification, your account number, your date of birth, and click ‘continue’

How to Enroll in your account

If you are a customer and you have a bank account with Wells FARGO then enrolling is provided freely. As mentioned earlier, the services provided by Wells Fargo’s online financial services are available for customers who have individual and business bank accounts.

Follow the steps to enroll:

Step 1: Go back to the homepage and click wellsfargo.com/signon, wf sign on, www wf com sign on now

Step 2: now you can enter your social security number; loan, Account, or ATM/ Debit card No.; email address and click continue

How to manage your Wells Fargo online account

Some of the benefits of enrolling for the online banking services offered by wells fargo login sign in include:

- Customers can find an ATM using the ATM locator on the bank’s website

- Get your e-Statement

- Make check requests

- Pay your bills online

- Transfer funds

Benefits of Well Fargo bank

Wells Fargo bank has been around for many years. They have discovered a few benefits that customers can take advantage of. There are many advantages of banking with Wells Fargo.

Same as a traditional bank, Wells Fargo also went a mile further to offer internet banking services that can be accessed from anywhere as long as the users have registered.

Advantages of Wells Fargo

- Wells Fargo has wide geographical coverage in the United States.

- Customers who have been maintaining a considerable amount of balance, the( $ 1,500 ad $ 5,00) will receive a free checking as well as a 0.05% APY

- Daily transfers to savings accounts are very low.

- It offers extensive classified financial services and banking to its customers all under one roof

- Customers can easily get their savings and checking fees waived

- Quality customer support

- Online banking services

- This website has a user-friendly interface and the bank provides mobile apps for iOS and Android users.

Wells Fargo also offers a few other useful and time-saving features such as:

- You can search up to 18 months of transaction history.

- You can know your available balance and pending transactions.

- You can locate your account or routing number at your fingertips. You can also view the front and back of your check images.

- You can manage your money from your desktop computer, a smartphone with easy access to download your transactions.

Reviews of Wells Fargo online financial services

Wells Fargo is an international banking and financial services company which is based in San Francisco, California. It was founded in 1852. The company has $ 2.0 trillion assets and the vision of the company is to satisfy the financial needs of its customers.

It offers banking mortgage, insurance and investment, personal and business finance through over 8500 locations. It also offers 13000 ATMs, online banking, and mobile banking in 42 countries and territories. So that it can provide support to the customers who run businesses in the global economy.

Wells Fargo has more than 70 million customers. This bank ranked 4th in assets among the banks in the U.S and also the most valuable bank in the world by market capitalization at the end of the first quarter of 2015.

The Barron’s Magazine named Wells Fargo “The most respected Bank” in the year 2014. In the past two years, the chronicle of philanthropy ranked the bank’s corporate cash in the top two among all the companies in the U.S

Wells Fargo savings and checking accounts

In a Wells Fargo checking account, a customer should have a minimum opening deposit of $50. The bank’s monthly service fee ranges from $10 and $30 depending upon the type of account.

You need to be aware of:

- An overdraft fee of $36.

- There will be a 3% fee on all international debit card transactions.

- High fees for out-of-network ATMs.

- Every transaction from saving accounts will obtain a 12.5% fee that has been linked for overdraft protection.

Savings accounts will have a minimum deposit of $25 and have a service charge fee of $5 each month, which is usually waived if a customer maintains a daily balance of $300, and if you are under 18 years or having recurring saving options.

When it comes to interest, you shouldn’t expect much because the APY is only 0.01%. Another best feature of this account is the bank’s automated savings feature and the ability to transfer as meager as $1 which makes this account easy and less intimidating to use.

Drawbacks

Just like other banks, Wells Fargo has its own disadvantages. The bank has many branches around the world and also certainly a few drawbacks that customers experience. They include:

- International travelers need to pay high fees. For example, if you don’t have $25,000 in your premier checking account, you will need to pay a foreign transaction fee of 3% and $5 for using ATMs that are located outside the United States.

- Customers having lower balances usually get laughable interest rates.

- A $2.50 fee for an out of network ATM.

- ATM network is not huge for this bank.

Wells Fargo faqs

How do I download the www.wellsfargo.com login personal account Mobile® app?

The Wells Fargo login personal account Mobile® app is available for Apple® and AndroidTM devices. Download the Wells Fargo Mobile App from the App StoreSM and Google PlayTM.

How do I access Wells Fargo login advisors online?

Wells Fargo login advisors Online from your desktop or mobile device for secure online access to your account. After you register, you will receive a confirmation email and be able to login and manage your account and for wellsfargo sign in to view accounts.

What do I need to register for www.wellsfargo.com login?

- ATM/debit or credit card number

- Wells Fargo account number

- social security or tax number

- Access your email

- Your current phone number

How to get username and password for Wells Fargo sign in to view your accounts?

For Wells Fargo bank login go to wellsfargoadvisors.com from your desktop or mobile device for secure online access to your account. During the registration process, you will choose a username and password.

Once you have registered, you can have wellsfargo sign on to view accounts. We encourage you to choose a unique username and password and remember them instead of writing them down.

I just opened a new account but I don’t see it through Wells Fargo advisors client login Online. What do I have to do?

Sign in to manage your online wells fargo advisors client login account credentials. Eligible personal and business accounts include checks and savings, credit cards, mortgages, stock accounts, personal loans and lines of credit, commercial loans, business lines of credit, auto loans, student loans, broker deals, IRAs, and CDs (time accounts).

If you don’t see the account you want to add, call 1-800-956-4442.

Is there a fee for using Wellsfargoadvisors login bill payment?

Not. There is no additional charge for using wellsfargoadvisors login Bill Pay.

What should I do as a customer if the password is blocked?

For your safety, we may block your access to Wells Fargo Online. You must create a new password to regain access at wellsfargoadvisors.com/login. For added protection, we also recommend that you change your username after logging in. If you do not have the information required to create a new password via Wells Advisors login Online, you should contact Online Customer Service at 1-800-956-4442.

How do I change my username and/or password?

Register and login at wellsfargoadvisors.com login and change your username or password from the menu.

Create a unique username and password (not used elsewhere) for Wellsfargoadv Online. We recommend that you remember your username and password instead of writing them down.

How do I change or add a different email address, phone number, or mailing address for wfblogin?

Simply log in to wfblogin Online and go to Update Contact Information to view your email, phone and mailing address. If your new address is outside the United States, please call us at 1-800-956-4442.

If you receive broker statements and documents electronically, you must register with Wells Fargo Online. To change the email address to which your notification will be sent, click the Mediation tab and under Customer Service, go to Document Delivery settings.

As a customer, Do I need to verify my email address?

As a Wells Fargo asset management login customer, you must maintain a valid email address with us to ensure that you receive important information related to your Wells Fargo account and receive timely notifications when your online documents are available.

How do I set, add, or remove notifications?

- Log in to Wellsfargofinancial com sign in and open Signal Management.

- Select the account you want to add or edit the notification.

- Check the boxes to enable or disable certain alerts.

- If necessary, enter the threshold value in dollars and the signal frequency.

- Save your changes.

How to register for the Wells Fargo Online Statement

Wells Advisors login Online offers the ability to receive and view online transfer reports for most of your accounts. Simply register to set a username and password to access your personal and business accounts online.

If you already have a username and password, sign in to view your bank statement online. To change how you want to receive transfer reports and other documents, go to wf com wellsfargo.com/auth/login/do.

What browser settings do I need to use wf com login?

To access wellsfargo com, JavaScript and cookies must be enabled in your browser.

Conclusion

Generally, wellsfargo comlogin is reliable, friendly, and personable. Many customers have said that they listen, respond and also help their customers to improve their finances and understand their money situation. This completes our post about wells Fargo.